A Legacy of Helping Business Owners Save Taxes

At Clear Advice, helping business owners make the most of every tax-saving opportunity is more than a service, it’s a family tradition spanning three generations.

Owning a business creates unique opportunities to integrate tax savings into every aspect of personal and financial planning. This Integrated Planning approach aligns business, retirement, tax, investment, and insurance strategies to help clients keep more money and pay less to the government.

One of the most effective tools to achieve this is the Qualified Retirement Plan. When designed and implemented creatively by experienced professionals, these plans can:

- Provide significant income tax deductions

- Accelerate personal wealth through tax-deferred growth

- Reward and retain valued employees.

- Be tailored so that business owners receive the maximum benefit allowed under IRS rules

Types of Retirement Plans:

- Pension Plans Traditional employee sponsored plans that provide fixed retirement benefits

- Defined Benefit Plans that guarantee specific retirement benefits based on salary and service.

- SIMPLE Plans Savings Incentive Match Plan for Employees of small businesses.

- Profit Sharing Plans where employers contribute a portion of company profits

- Hybrid & Cash Balance Plans Combines features of Defined Benefit Plan and defined contribution plans

- Keogh Plans Qualified plans for self-employed individuals and unincorporated businesses.

- 401(k) Plans Popular plans allowing employee contributions with employer match options

- SEP IRAs Simplified Employee Pension with easy administration and high contributions.

Why Should Business Owners Care?

Qualified retirement plans aren’t just employee benefits, they’re powerful financial tools for business owners.

Key Advantages:

- Big Tax Savings

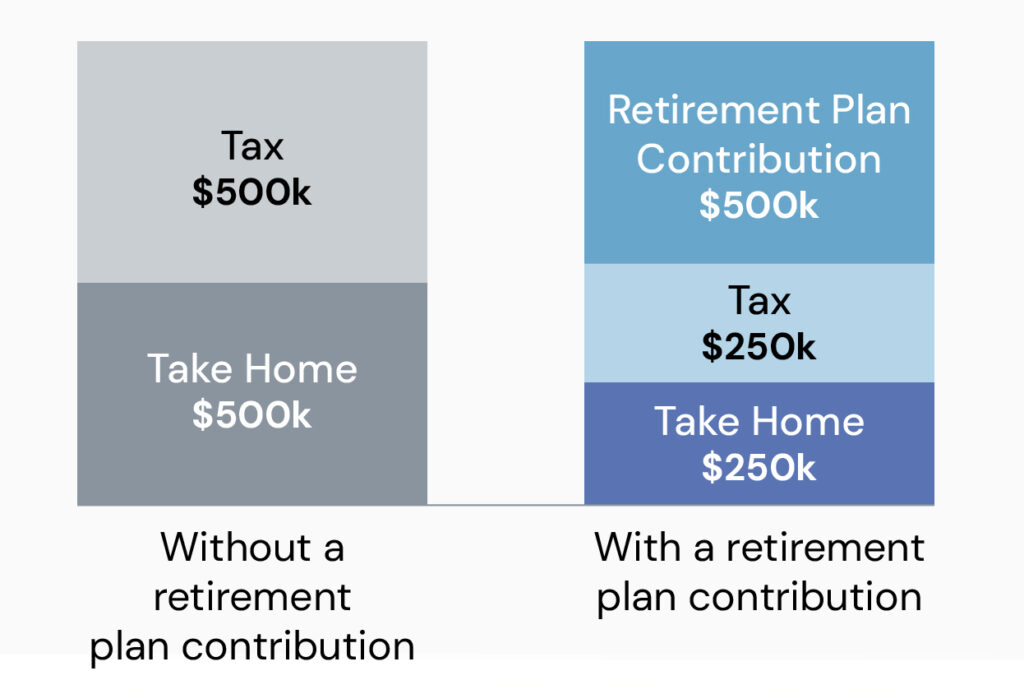

Contributions you make to a qualified plan are typically tax-deductible, reducing your current taxable income. For a profitable business owner, every dollar put into a retirement plan could save you a significant amount in taxes. It’s like paying yourself instead of the IRS. Plus, the money in the plan grows tax-deferred, so earnings aren’t taxed each year either. - Wealth Accumulation for Owners

A well-designed plan can be skewed in your favor (legally). While you must include employees in the plan, there are creative plan design techniques that allow owners to receive a larger share of the contributions. Over time, these contributions and their investment growth can build a substantial nest egg for your own retirement. - Employee Motivation & Retention

Offering a retirement plan helps attract and retain talented employees. It shows you’re investing in your team’s future. Employees are motivated when they see you contributing to their retirement; it builds goodwill and loyalty. In some cases, the promise of an employer-funded retirement benefit can set you apart from other employers and reduce staff turnover. - Flexible & Customizable

You have the flexibility to choose and design a plan that fits your business size, goals, and cash flow. For example, a business with steady profits might add a Cash Balance Pension Plan on top of a 401(k) to dramatically increase owner contributions, while a smaller business might start with a SIMPLE IRA for ease. You can also adjust contribution levels year by year (with plans like profit-sharing) if needed.

In short, a qualified plan can serve as a tax-efficient wealth bucket for you, and a meaningful benefit for your employees. More advanced plans can also be designed to allow for contributions well beyond the traditional maximum annual contributions to an IRA or SEP. Through careful auditing and tailored solutions, we can significantly enhance contributions and the owner’s allocation share as evidenced by a recent case study.

Rules & Regulations

Navigating the intricate world of qualified retirement plans requires adherence to rules and regulations set by Congress and the Department of Labor. A misstep can lead to personal liability as a plan trustee. Therefore, it’s crucial to collaborate with proficient ERISA attorneys, pension consultants, or actuaries.

Case Study: From 36% to 77% to the Owner

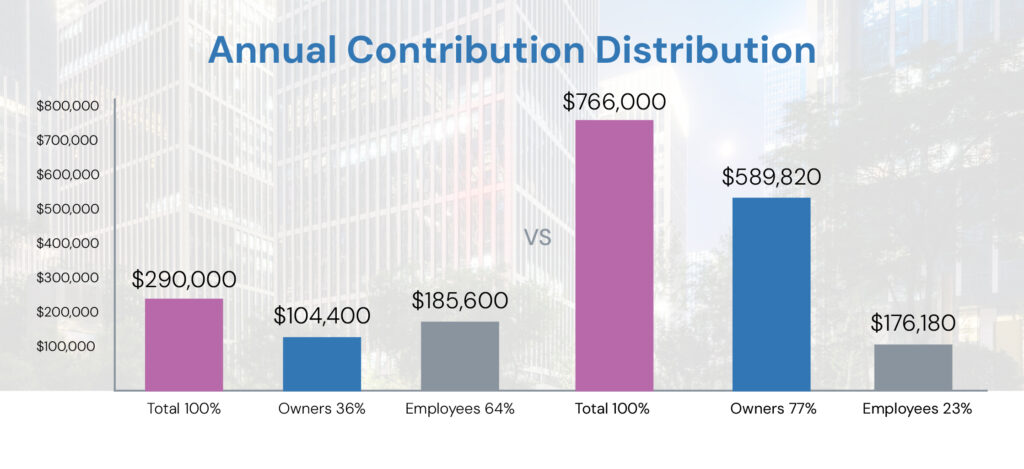

Meet Bill, a 60-year-old owner of a successful manufacturing company. Bill’s company generated substantial income, and like many business owners, he sought ways to reduce income taxes. Ten years ago, Bill implemented a 401(k)/profit-sharing plan to provide retirement benefits to his employees while maximizing tax-deductible contributions for himself and his family. However, the plan allocated only 36% of the annual contribution to Bill and his family, frustrating his efforts.

Working with the Clear Advice team, the company implemented a Cash Balance Pension Plan alongside his existing 401(k). This type of plan allowed a much larger, additional contribution each year, heavily weighted toward an older owner like Bill, while still staying within IRS non-discrimination rules. The results were dramatic: The company was able to contribute an extra $421,000 per year, for a total of about $766,000 annually between the two plans – with roughly 77% of that total benefiting Bill and his wife.

The remaining portion still provided generous contributions for his 20+ employees, keeping the plan fair and compliant. By creatively integrating a new plan, Bill slashed his taxable income (saving hundreds of thousands in taxes each year) and turbocharged his personal retirement fund. This case illustrates how the right plan design can tilt benefits toward the business owner in a fair way. If you’re a business owner like Bill, it’s worth exploring whether a custom plan design could dramatically increase your own share of retirement contributions.

Designing the Right Plan

Every business is unique, and the beauty of qualified retirement plans is that they can be custom-crafted to fit your situation. Designing the right plan starts with understanding your goals. Do you want to maximize your own contributions? Reward key employees? Or all three? Understanding your workforce, the classification of employees, ages and compensation levels can dramatically influence your plan design. At Clear Advice, we specialize in finding the “sweet spot” that satisfies IRS rules while heavily benefiting the owner. It’s important to note that qualified plans must follow strict regulations to ensure they don’t unfairly favor owners or high earners exclusively. Rules like anti-discrimination testing and contribution limits are in place to protect employees. Compliance is key, which is why we handle the technical heavy lifting for you.

Clear Advice designs qualified retirement plans with a focus on investment strategies that align with a target return specific to your plan. Options may include:

- Liquid, Low cost ETFs broad market exposure with low fees and high transparency

- Equity ETFs with downside protection structured to limit losses in market downturns while capping upside to manage risk

- Custom fixed income strategies designed to provide income while reducing risk

All portfolios are customized and adhere to rules that govern your specific qualified retirement plan. When the plan is dissolved or a participant leaves, assets can be seamlessly rolled into individual IRAs for each participant, preserving tax-deferred growth and investment flexibility.

Who Are the Players?

Designing and running a qualified retirement plan involves a team of specialized players, and Clear Advice will coordinate with them on your behalf:

Financial Advisor (Clear Advice)

We act as your quarterback and fiduciary advisor, helping design the plan strategy and manage the investments. Our role is to ensure the plan aligns with your financial goals and runs smoothly.

Third-Party Administrator (TPA)

A pension consulting/TPA firm handles the paperwork and annual compliance testing. They make sure your plan meets all IRS and Department of Labor requirements each year and helps design plan provisions (like eligibility, contribution formulas) to maximize benefits for you.

Recordkeeper

This party keeps track of all the accounts and contributions. In a 401(k)-style plan, the recordkeeper updates each participant’s balance and handles transactions like contributions and distributions. Essentially, they do the accounting behind the scenes.

Custodian

The custodian is like the plan’s bank, they physically hold the assets (ETFs, stocks, etc.) in the plan and facilitate trades. They keep the money safe and separate from the company’s assets.

As a business owner, you don’t need to individually manage all those moving parts, that’s our job. We assemble the right team and coordinate these players so that your plan is administered correctly and efficiently.

Getting Started: Step-by-Step Plan

1. Initial Consultation & Analysis

We begin with a conversation to understand your business and goals. This complimentary analysis looks at your financials, current tax situation, and any existing plans. We’ll identify opportunities and estimate the potential tax savings and benefits if you start a plan or enhance your current one. (This is where we determine if a qualified plan could integrate well into your overall financial plan.)

2. Custom Plan Design

Next, our team (including pension design specialists) crafts a plan tailored to you. We choose the type of plan (or combination of plans) that best fits your needs – whether that’s a 401(k) with profit-sharing, a Cash Balance Pension Plan, a Defined Benefit Plan, or a combo. Every detail – eligibility, contribution formulas, vesting schedules – is designed strategically. The goal is to maximize the owner’s benefit while keeping the plan fair and within regulations. Before anything is finalized, we review the design with you in plain language so you understand how it works and what it will do for you and your employees.

3. Implementation & Setup

Once you approve the plan design, we take care of the setup. This includes preparing plan documents (usually handled by the TPA), establishing investment accounts with the custodian, and setting up the recordkeeping system. We’ll help you communicate the new benefit to your employees and handle enrollment. At this stage, all the pieces – advisor, TPA, recordkeeper, custodian – come together to launch the plan. We make sure all filings and legal requirements are handled properly so you can start contributing with confidence.

4. Ongoing Management & Support

After the plan is up and running, our job continues. Each year, we’ll work with the TPA to conduct required non discrimination testing and prepare any government filings (like the Form 5500). We’ll meet with you regularly to review the plan’s performance, ensure the investment strategy is on track, and adjust contributions or plan features if your situation changes. Essentially, we monitor and maintain the plan so it keeps delivering value. And of course, we’re on call for any questions – whether it’s about adding a new employee to the plan, or considering additional strategies to enhance your benefits.

Conclusion

Qualified retirement plans are among the most powerful tools in a business owner’s financial toolkit. They offer a rare combination of immediate gratification (income tax savings today) and long-term benefit (wealth for tomorrow), all while helping your employees build their futures as well. The key is having the right plan customized for your situation, and the right team to design and manage it. With the generations of experience implementing these strategies at Clear Advice, and our hands-on approach, we ensure that any plan you put in place truly works for you. If you’re a business owner, CPA, or trusted advisor reading this, we encourage you to take the next step. Find out, with no cost or obligation, whether a qualified retirement plan could amplify your financial strategy. Schedule a complimentary plan analysis with us to see what type of plan (if any) makes the most sense and how much you could potentially save and accumulate.