Client Profile

An established medical practice generating $25M in annual revenue was owned by three long-time physicians. Two partners were nearing retirement, while the third—married to one of them—wished to continue practicing with the acquiring company. During the transaction, the Physician/Husband passed away, requiring urgent estate planning as part of the exit process.

The Problem

After decades of profitability, the practice faced sudden cash flow issues due to changes in Medicare reimbursement policies and mismanagement by a departing partner. This drastically reduced the business value.

On top of this:

- The three doctors had conflicting goals for their exit timelines.

- One partner became terminally ill mid-process.

- Financial records were disorganized and outdated.

- A $12M sale fell through due to insurance contract restrictions.

- The practice had no internal financial leadership, no updated compliance records, and poor visibility by office location.

Emotional stress, financial uncertainty, and poor internal systems threatened both the business and personal futures of the owners.

The Solution

Clear Advice Financial led a comprehensive Business Exit Planning process that included:

Stabilizing cash flow by adjusting Medicare billing practices.

Building a team of qualified advisors (M&A attorney, CPA, estate planner).

Rebuilding financial records and preparing clean books for sale.

Creating three unique exit paths tailored to the goals of each owner.

Negotiating a successful merger with a strategic buyer.

The Result

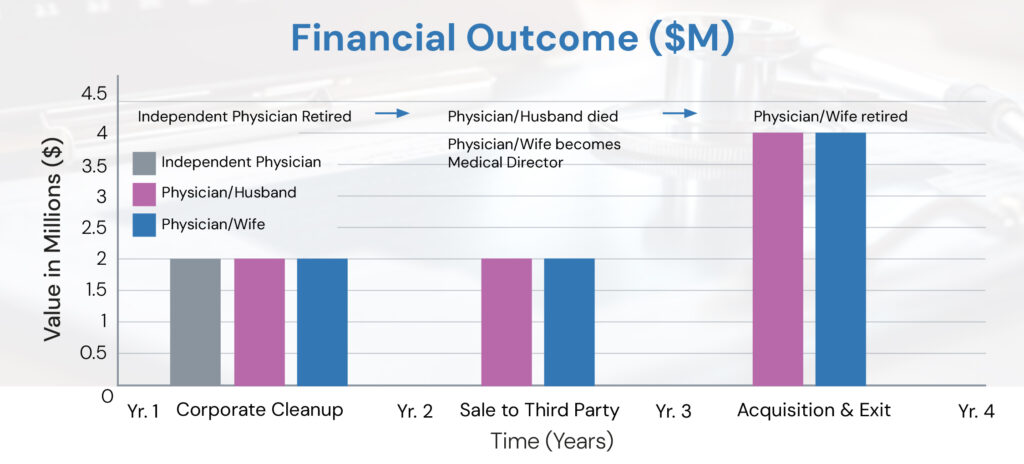

- The Independent Physician decided to fully retire and sold his shares for $2m.

- The shares of the Physician/Husband who died during the exit process, worth $2m went into an Irrevocable Trust with his Physician/Wife controlling his shares as trustee.

- The Physician/Wife conducted a stock swap with her $2m valued stock and the Trust’s $2m valued stock for a 10% interest in the $40m acquiring company and became its Medical Director.

- Three years later, the acquiring company sold to a large healthcare company for $80m, doubling its value. The combined 10% interest by the clients of Clear Advice doubled in value – from $4m t o $8m in only three years. The Physician/Wife was able to fully retire, with the security of her funds and access to her husband’s trust for additional income.